This case study explores the successful collaboration between Reliasourcing and a technology-driven loan processing company that sought to enhance efficiency and scale its operations. Consequently, with rising customer service demands, the client sought a strategic outsourcing solution to streamline the loan processing system, aiming to ensure high quality throughout the process.

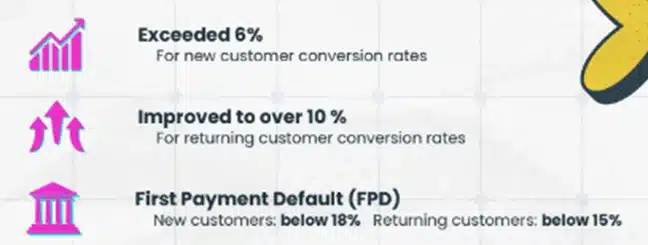

Reliasourcing implemented a customized training program focusing on compliance, customer communication, and specialized tasks like Instant Bank Verification (IBV). As a result of this structured training approach, the client’s team was able to scale significantly—from 9 representatives to 46—while also maintaining high standards. Consequently, this initiative resulted in a remarkable 230% improvement in operational efficiency, along with higher loan approval rates and reduced first-payment default rates.

Loan Processing Key Metrics

Approved applications

The partnership between Reliasourcing and the client not only allowed the latter to focus on core business growth but also benefited from expert support in loan processing. The collaboration showcases how tailored outsourcing and continuous training can be pivotal in achieving scalable, reliable operations.

Download the complete case study to discover how customized outsourcing solutions can improve business efficiency.

Fill out the form now to get a copy

Looking to streamline your loan processing and scale your operations with expert support? Partner with Reliasourcing for tailored outsourcing solutions that drive efficiency, compliance, and growth. Contact us today to explore how we can help your business succeed.