Many Filipino employees want to grow their savings without taking on high financial risk. And with rising living costs and the shift toward personal financial responsibility, there’s a growing need for savings options that are both safe and rewarding. Pag-IBIG MP2 is one of the easiest ways to achieve this, with its government-backed, flexible, and specifically designed structure for Filipinos who want higher returns than traditional bank accounts.

In this guide, you’ll learn what MP2 is, how it works, how much you can earn, and how to decide if it’s the right savings program for your financial goals.

What Pag-IBIG MP2 Is and Why It Matters

Pag-IBIG MP2, or the Modified Pag-IBIG 2 Savings Program, is a voluntary savings program for members who want to grow their money at a higher rate than regular Pag-IBIG contributions, open to both active and former Pag-IBIG members, including retirees.

The savings program stands out because it offers a rare combination of strong returns, low risk, and government backing. For Filipino workers seeking a stable place to save, MP2 provides an accessible entry point to disciplined, long-term savings.

How Pag-IBIG MP2 Works

Understanding how Pag-IBIG MP2 works helps Filipino employees see why it’s become a popular savings choice. The program keeps things simple: you decide how much to save, Pag-IBIG invests the money in secure government-backed programs, and your contributions grow through annual dividends.

Flexible Contributions That Fit Your Budget

MP2 doesn’t require a fixed monthly contribution, and you only need a minimum deposit of ₱500. You decide how often you want to save:

| Contribution Style | Description | Best For |

| Monthly Contributions | Fixed savings are added every month | Employees building steady financial discipline |

| Occasional Deposits | Contribute only when you have extra money | Workers with variable income or irregular budgets |

| Lump-Sum Contribution | One-time large deposit | Savers with bonus, 13th month, or extra cash on hand |

The flexibility makes MP2 friendly for different income levels, from entry-level employees to higher earners who want a structured savings strategy.

How Pag-IBIG Invests MP2 Funds

Pag-IBIG invests MP2 savings into government-backed and income-generating programs, including:

- Housing loans

- Government securities

- Corporate bonds and other safe financial instruments

The investments help maintain MP2’s low-risk profile while giving members better returns than many traditional savings products.

Understanding MP2 Dividends

Dividends are distributed annually and can be received in two ways:

- Compounded dividends – All earnings stay in the account for 5 years

- Annual payout – Dividends are released yearly through your bank

| Dividend Option | How It Works | Advantages | Considerations |

| Compounded | Dividends stay in the account until maturity | Higher total return due to compounding | No dividend withdrawal until the 5-year term ends |

| Annual Payout | Dividends released yearly to your bank | Yearly cash flow | Slightly lower total return vs compounding |

Compounding typically yields higher total earnings at the end of the 5-year term, making it a popular choice for long-term savers.

How Much You Can Earn With MP2

Dividend rates vary each year based on Pag-IBIG’s performance, but the program has consistently offered higher rates compared to regular Pag-IBIG savings and typical bank deposits. To give you a clearer picture, here’s the dividend rates between the two programs since 2020:

| Pag-IBIG Savings Dividend Rates (2020-2024) | ||

|---|---|---|

| Year | Regular Savings | MP2 Savings |

| 2024 | 6.60% | 7.10% |

| 2023 | 6.55% | 7.05% |

| 2022 | 6.53% | 7.03% |

| 2021 | 5.50% | 6.00% |

| 2020 | 5.62% | 6.12% |

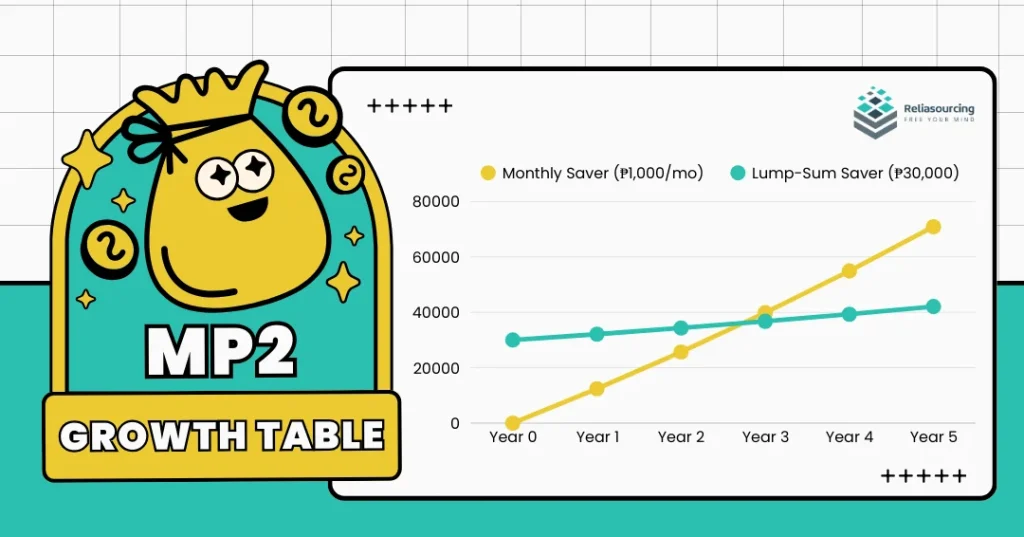

Scenario 1: You save ₱1,000 monthly for 5 years

- Contributions: ₱60,000

- Possible total after dividends: noticeably higher, depending on the annual rate

Scenario 2: You deposit ₱30,000 as a lump sum

- Your money grows through yearly dividends

- Compounding yields the best return at maturity

The scenarios contextualize how even small, consistent deposits can accumulate into meaningful savings after five years. Now, the line graph below compares the two scenarios to provide a more comprehensive outlook into both, assuming the dividend rate is at 7% annually, compounded:

Benefits of Opening an MP2 Account

Pag-IBIG’s MP2 Savings stands out for several reasons:

- Government-guaranteed, offering peace of mind.

- Historically provides higher returns than regular savings accounts or time deposits.

- Fits short- and mid-term goals like tuition funds, emergency savings, or future investments.

- Perfect for first-time savers who want a structured but flexible program.

- Encourages long-term saving habits that help employees build financial stability.

Potential Downsides and What to Consider

While MP2 is a strong savings tool, it’s important to understand its limitations:

- The 5-year lock-in period means the money isn’t meant for quick withdrawals.

- Dividends depend on Pag-IBIG’s yearly performance, although rates have remained competitive.

- Contributions aren’t automatic unless you set up payroll deduction or scheduled transfers.

- It’s best to compare it with other options to determine if it aligns with your goals, income, and timeline.

How to Open a Pag-IBIG MP2 Account

Opening a Pag-IBIG MP2 account is a straightforward process that takes only a few minutes, whether you choose to do it online or at a branch. Once you have your Pag-IBIG number and a valid ID, you can enroll and start saving right away. The steps below outline everything you need to get started smoothly.

Requirements

You only need:

- Pag-IBIG MID number

- Valid government ID

- Active Pag-IBIG membership or previous contributions

Step-by-Step Enrollment Guide

- Visit the Pag-IBIG website and navigate to the MP2 online enrollment page.

- Fill out your personal details and choose between compounded or annual payout.

- Submit the form to generate your MP2 account number.

- Pay through any of the following:

- Online banking

- Payroll deduction

- Mobile wallets

- Over-the-counter partner banks

- Track your savings through the Virtual Pag-IBIG portal.

Is MP2 Right for You?

MP2 works well for employees who want reliable growth without taking on aggressive market risks, since it supports goals such as:

- Building an emergency buffer

- Saving for a child’s education

- Preparing capital for a future business

- Strengthening long-term financial security

If you have a stable income and want to save steadily over five years, MP2 can be a great option.

Frequently Asked Questions (FAQs)

What is the minimum amount I can put in MP2?

The minimum amount you can deposit into MP2 is ₱500 per transaction, which can be made at any time depending on your preferred contribution schedule.

How often do I need to deposit?

How often you need to deposit depends entirely on your preference since MP2 doesn’t require fixed monthly payments. You can deposit monthly, occasionally, or in a single lump sum.

How can I withdraw my MP2 savings after 5 years?

You can withdraw your MP2 savings after 5 years by submitting a maturity withdrawal request through the nearest Pag-IBIG branch or the Virtual Pag-IBIG portal.

Does MP2 have any penalties for missing deposits?

MP2 does not have any penalties for missing deposits because the program doesn’t require fixed monthly contributions.

Can I open more than one MP2 account?

You can open more than one MP2 account. Should you have separate and different financial goals, you can open multiple accounts.

Final Thoughts

Saving consistently can be challenging, especially when financial demands compete for your attention. MP2 offers a way for Filipino employees to grow their money with confidence and flexibility, backed by government security, and rewarding discipline without requiring large monthly contributions, making it one of the most accessible savings programs available today.

If you’re looking for a safe and practical way to start building long-term savings, MP2 is a strong option to consider.

Explore more practical financial guides in our Trends & Insights section to stay informed about strategies that help you build long-term financial stability. Feel free to share this article with colleagues or friends who want to understand MP2 better or are planning to improve their savings this year.

Friendly tip: This is only a quick overview of the Pag-IBIG MP2. For additional questions or inquiries, it is best to contact your HR department directly or reach out to the government agency via their Pag-IBIG Virtual site or email contactus@pagibigfund.gov.ph.

Love our culture of financial growth? Want to be part of a workplace that ensures your economic security? Check out our Careers Page to see if you’re a perfect fit for one of our roles! Be part of #LifeAtReliasourcing.

About Reliasourcing

Reliasourcing is a premier outsourcing solutions provider in the Philippines. We deliver tailored services that help businesses across industries achieve operational efficiency and scalability. With a focus on customer experience and innovation, Reliasourcing continues to be a trusted partner in unlocking potential through outsourcing.

Follow us on Facebook, Instagram, LinkedIn, YouTube, and X for more information on the latest trends and insights in outsourcing, the industry, and the Philippines.

Connect with us, or become part of our growing team today!