Outsourcing remains a fundamental business strategy in 2025, allowing companies to streamline operations, reduce costs, and access global talent pools. Over the past few years, the industry has undergone significant changes, with businesses adopting new models to enhance efficiency and scalability. While traditional outsourcing practices hold value, technological advancements and shifting economic conditions have reshaped how companies approach outsourcing.

Industries such as technology, finance, healthcare, and e-commerce continue to benefit from outsourcing. The rise of automation, artificial intelligence (AI), and hybrid work models have also introduced new possibilities for businesses looking to optimize their operations. Meanwhile, ethical outsourcing and sustainability practices are becoming central considerations for decision-makers.

This article on The State of Outsourcing and its current trends aims to provide a comprehensive overview of outsourcing in 2025, now that we’re a few months in. We will examine key trends from 2024, analyze the current state of outsourcing in the 1st quarter of 2025, discuss industry challenges and solutions, and explore what lies ahead for the remainder of the year.

As outsourcing continues to evolve, it becomes more crucial for companies to stay up-to-date on the latest developments. This article will outline where the industry stands today and offer foresight into how businesses can prepare for future trends and opportunities.

2024 Lookback: Key Trends & Insights

Market Performance and Growth

The outsourcing industry experienced significant expansion in 2024, driven by the increasing demand for cost-effective business solutions. Companies across various sectors sought outsourcing partners to streamline operations and improve efficiency. The growing reliance on digital transformation and AI-powered solutions further fueled the industry’s growth.

Global Outsourcing Market Expansion

The global business process outsourcing (BPO) market saw a substantial increase in valuation, reflecting its continued importance in business operations:

- The market size was estimated at $280.64 billion in 2023.

- In 2024, the market expanded further, reaching $315.46 billion.

This growth highlights the rising demand for outsourcing services as companies seek to optimize costs and enhance productivity through specialized external partnerships.

The Philippine BPO Industry’s Growth

The Philippines continues to be a dominant player in the global outsourcing landscape. Recent statistics indicate the country’s BPO sector experienced steady expansion:

- Revenue Growth. The Philippine BPO market grew from $35.4 billion in 2023 to $37.87 billion in 2024, maintaining a 7% Compound Annual Growth Rate (CAGR).

- IT-BPM Revenue Milestone. The Information Technology and Business Process Management (IT-BPM) industry in the Philippines achieved $38 billion in revenue in 2024, meeting its projected targets amid strong demand from global firms.

Employment and Talent Supply

The expansion of the BPO sector has also led to significant job creation and talent supply in the Philippines:

- Workforce Growth. The IT-BPM sector employed 1.82 million workers in 2024, up 7% from 1.7 million employees in 2023.

- Skilled Talent Pool. With approximately 350,000 college graduates entering the workforce annually, the Philippines remains an attractive outsourcing destination, offering a competitive labor market for multinational firms.

The outsourcing industry’s strong market performance and expansion highlight its increasing role in global business operations. The Philippines, in particular, continues to reinforce its position as a key outsourcing hub, driven by a skilled workforce, steady revenue growth, and a favorable business environment for offshoring solutions.

Industries with the Most Outsourcing Growth

Outsourcing has become a necessity for the world’s leading companies. 57% of G2000 companies from the Forbes 2024 Global 2000 list leverage outsourcing to streamline operations, reduce costs, and drive innovation. The widespread adoption underscores the integral role outsourcing plays in global business strategy. As companies continue to optimize their operations, outsourcing remains a key driver of scalability and efficiency.

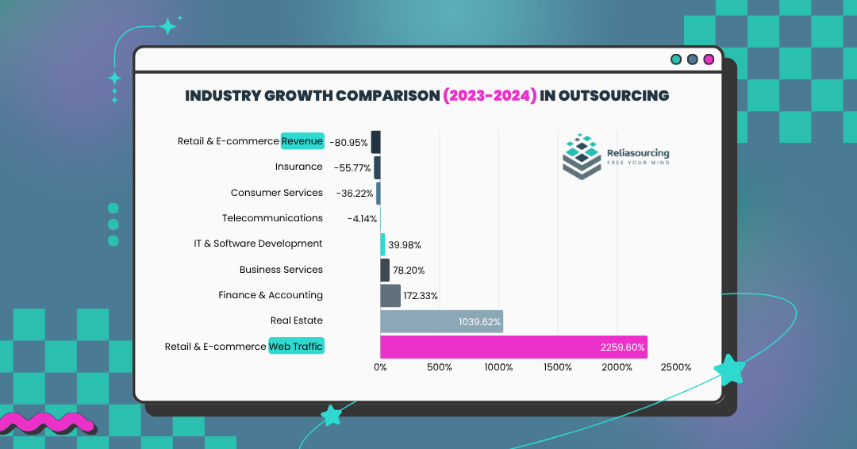

The outsourcing industry expanded substantially in 2024, driven by increasing demand for cost-efficient solutions across multiple sectors. Companies embraced outsourcing to enhance operations, optimize costs, and integrate digital transformation strategies. Industries such as finance, real estate, and e-commerce experienced the highest growth, while traditional sectors like telecommunications and consumer services declined due to automation and market shifts.

Top Industries Driving Outsourcing Growth

The data below is sourced from Outsource Accelerator’s OA500 reports, highlighting the industries experiencing the most significant growth in outsourcing.

Finance & Accounting Outsourcing (FAO)

- Growth: +172.33% since 2023 | +69.91% from 2024

- Increased demand for payroll processing, tax preparation, and risk management.

- Finance BPO firms experienced a 5,718.48% increase in web traffic, reflecting substantial market expansion.

Real Estate Outsourcing

- Growth: +1039.62% (from $77.3M in 2024 to $880.6M in 2025)

- Expansion in property management, real estate analytics, and virtual assistance.

- AI adoption is reshaping real estate data analysis.

Retail & E-commerce Outsourcing

- Growth: +2259.60% in web traffic from 2023 to 2024, but despite high web traffic, revenue growth was inconsistent at -80.95%

- Rising demand for customer support, supply chain management, and digital marketing outsourcing.

- The surge in online shopping and AI automation is fueling growth.

IT & Software Development Outsourcing

- Growth: +39.98% over two years, but a -5.41% revenue dip in 2024

- Increased reliance on cloud computing, cybersecurity, and AI-driven development.

- Competitive pressures and AI automation are reshaping the industry.

Business Services Outsourcing

- Growth: Represented 78.2% of all outsourcing firms in 2024

- Includes customer service, HR, back-office support, and data processing.

- Despite its size, web traffic to business service firms declined 45.39% from 2023.

Industries Facing Decline in 2024

While some industries thrived, others experienced declining outsourcing adoption due to automation and changing market demands:

- Telecommunications (-4.14%)

- Consumer Services (-36.22%)

- Insurance (-55.77%)

- Healthcare, HR & Staffing, and Management Consulting (Zero measurable traffic in 2024)

Industries like Finance, Real Estate, and E-commerce are experiencing significant outsourcing growth due to technology integration and operational efficiencies. However, traditional service-based sectors such as telecommunications and consumer services are declining due to AI automation and shifting business models. As the outsourcing landscape evolves, businesses must adapt by leveraging digital solutions and specialized service providers to remain competitive.

The Rise of AI-Driven Outsourcing

Artificial intelligence (AI) and automation dominated new outsourcing deals in 2024, driving growth across industries despite ongoing challenges in customer satisfaction. According to the ISG Star of Excellence CX Insights Report, enterprises are increasingly adopting AI and automation to boost efficiency and reduce costs. However, this surge comes with a trade-off: a measurable dip in overall customer experience (CX), particularly with emerging technologies like generative AI.

While AI has become a core differentiator in outsourcing strategies, the report reveals that generative AI (GenAI) received the lowest CX ratings among new technologies, contributing to a broader decline in satisfaction scores—down over 3% year-over-year, underscoring a gap between enthusiasm for AI and its practical execution. As Heiko Henkes of ISG notes, CX is more critical than ever, especially amid recent global tech outages. Providers must now prioritize innovation, consistency, and user-centric design in their AI-powered services to retain and maintain an edge.

Ethical and ESG-Focused Outsourcing

In 2024, ethical outsourcing and ESG (Environmental, Social, and Governance)-focused partnerships have emerged as defining criteria for businesses selecting outsourcing providers. As consumer awareness and investor scrutiny around sustainability intensify, companies are under growing pressure to demonstrate that their outsourced operations align with responsible business practices.

Key Drivers Behind the Trend

- Regulatory Initiatives. New laws such as the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) and updated SEC disclosure rules have mandated stricter oversight of labor rights, carbon emissions, and governance practices within supply chains—outsourcing included.

- Investor and Consumer Expectations. ESG performance has become a proxy for long-term business stability. Companies outsourcing to providers with strong ESG track records are viewed more favorably by both institutional investors and the public.

- Reputation Management. Ethical lapses in outsourcing—such as poor working conditions or non-compliance with environmental standards—can trigger reputational damage and financial losses. As a result, brands are proactively seeking partners that uphold high standards in areas like fair labor practices, data privacy, and environmental stewardship.

How Providers Are Responding

- Third-party certifications (e.g., ISO 14001, SA8000) and transparent reporting frameworks are increasingly used by outsourcing firms to showcase ESG compliance.

- Some BPOs invest in green infrastructure and reduce emissions by digitizing operations, using renewable energy, and eliminating paper-heavy processes.

- Social impact outsourcing, which focuses on hiring from marginalized communities or supporting economic development in underserved regions, is gaining traction.

- Several outsourcing firms in the Philippines now publicly report on ESG KPIs as part of their client acquisition strategy.

Q1 2025 Trends: Where Outsourcing Stands Today

The outsourcing landscape in Q1 2025 is being reshaped by the following significant developments, according to Outsource Accelerator:

- AI and Automation. At the heart of outsourcing innovation, 73% of companies adopt AI to boost efficiency. AI tools increasingly handle tasks like customer service, data entry, and analytics, while generative AI supports content creation and feedback analysis. The shift brings cost efficiency, greater accuracy, and a need for upskilled talent.

- Strategic Partnerships. Outsourcing has moved beyond transactional relationships. By 2025, over 60% of organizations will involve outsourcing partners in strategic planning. Providers now offer tailored solutions, long-term contracts, and business consultancy roles to support innovation and agility.

- Data Security and Compliance. Data breaches cost companies an average of $4.45 million, so outsourcing firms are strengthening cybersecurity. Encryption, blockchain, and industry certifications like SOC 2 and ISO 27001 are now essential for compliance with regulations like GDPR and HIPAA.

- Sustainability and Ethics. Environmental and social responsibility is becoming central. BPOs are adopting green operations, energy-efficient systems, and fair labor practices to meet rising consumer and corporate expectations. In 2025, sustainable outsourcing will no longer be optional—it will be a competitive edge.

Frequently Asked Questions

What are the top industries experiencing outsourcing growth in 2025?

Finance, real estate, and e-commerce are the biggest movers this year. According to the OA500 report, finance outsourcing alone saw a 69.91% year-over-year growth, with real estate and e-commerce close behind, thanks to increased demand for analytics, customer support, and digital infrastructure.

Why is customer satisfaction declining despite AI adoption?

While AI has accelerated response times and efficiency, many customers lack personalization—especially with generative AI. The latest CX report shows a 3% dip in satisfaction, highlighting a gap between automation benefits and human-centered service.

To address this, outsourcing companies are refining their approach: integrating human oversight into AI systems, using feedback analytics to adjust interactions, and adopting hybrid service models that blend automation with real-time human support. The goal is to preserve efficiency while reintroducing emotional intelligence and personal connection where it matters most.

How is data privacy being addressed in outsourcing?

With digital transformation accelerating, data privacy is now a baseline requirement. Outsourcing providers enforce encrypted communications, role-based access, and regulatory compliance with GDPR and CCPA. Regular audits and due diligence are also standard practice.

What is ethical outsourcing, and why does it matter?

Ethical outsourcing prioritizes transparency, fair labor, sustainability, and community impact. With new ESG disclosure laws and rising consumer expectations, companies are now choosing providers who can prove their commitment to social responsibility.

How Reliasourcing Adapts to 2025 Outsourcing Trends

At Reliasourcing, we’re excited about the future of outsourcing and are committed to making it a reality today. Integrating artificial intelligence to support our teams enhances their work and efficiency. Clients enjoy lower operational costs and greater accuracy while still receiving that personal touch that makes a difference in customer experience.

Partnering with our clients is a priority for us. We act as service providers and collaborators invested in their growth. Offering tailored solutions and ongoing advisory support allows us to work closely with each client to meet their business goals and create lasting value.

Utilizing today’s flexible workforce, we engage distributed teams and gig economy professionals, enabling us to quickly scale up or down and tap into specialized skills based on project needs. Additionally, our capabilities allow clients to benefit from quicker communication and better time zone alignment, especially with our teams in the Philippines. Our setup minimizes friction and helps us deliver results faster while ensuring we remain in sync with our clients’ needs.

In Summary

In 2025, outsourcing continues to be a vital business strategy, enabling companies to optimize operations and access global talent. The industry has undergone significant changes in recent years, shaped by technological advancements like automation and AI and a growing focus on ethical and sustainable practices.

The global outsourcing market saw impressive growth in 2024, expanding from $280.64 billion to $315.46 billion. The Philippines emerged as a dominant player, boasting a BPO sector revenue of $37.87 billion and employing 1.82 million workers. Key industries, particularly finance, real estate, and e-commerce, significantly increased their outsourcing activities to leverage cost-effective solutions, while traditional sectors faced declines due to automation.

As businesses navigate these changes, staying informed about emerging trends and best practices in outsourcing will be crucial for maintaining competitiveness and unlocking future opportunities.

About Reliasourcing

Reliasourcing is a premier outsourcing solutions provider in the Philippines. We deliver tailored services that help businesses across industries achieve operational efficiency and scalability. With a focus on customer experience and innovation, Reliasourcing continues to be a trusted partner in unlocking potential through outsourcing.

Connect with us, or become part of our growing team today!